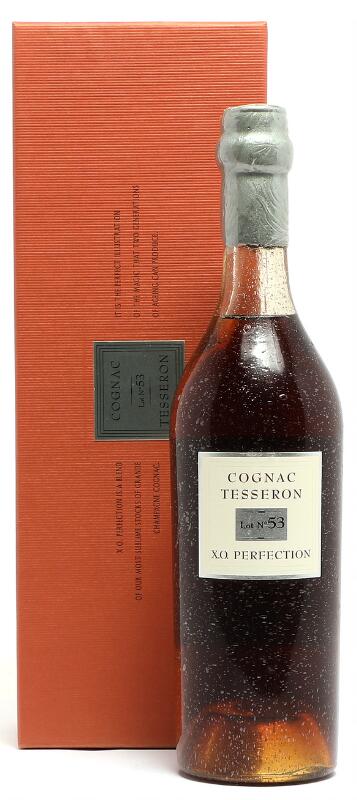

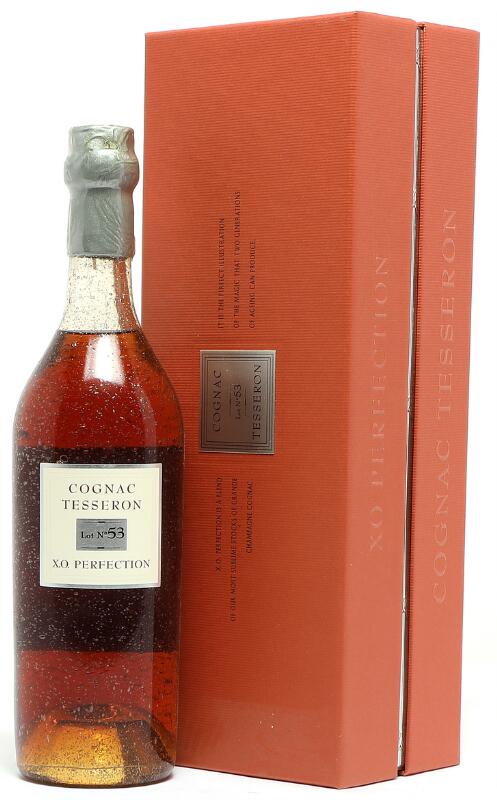

Cognac Tesseron Lot No 53 X.O. Perfection NV Cognac Tesseron Lot No 53 X.O. Perfection NV Lots 153-155: Wax capsules, packed in individual presentation oc within oc Lot 153 ♦ 6 bts (oc) Lot 154 ♦ 6 bts (oc) Lot 155 ♦ 6 bts (oc) per lot: GBP 500-600 per lot: USD 650-780 per lot: EUR 580-700 LYING IN OCTAVIAN, WILTSHIRE Offered In Bond, available duty paid These items are in bond. The buyer has a choice of taking the item in bond (with the sale being made in bond) or taking the item duty paid. If taken in bond, VAT will not be charged on the hammer price. VAT will be charged at 20% on the buyer's premium which may not be cancelled or refunded by Sotheby's. If taken duty paid, when Sotheby's releases the property to buyers in the UK, the buyer will become the importer and must pay Sotheby's duty at the current rate and import VAT at 20% on the hammer price + duty which may not be cancelled or refunded by Sotheby's. VAT will be charged at 20% on the buyer's premium which may not be cancelled or refunded by Sotheby's. (VAT - registered buyers from the UK should note that the invoice issued by Sotheby's showing import VAT payable, is not suitable evidence for recovering that VAT. In order to recover this as input tax, a VAT registered buyer must purchase the wine in bond and clear it under his own name and VAT number. HM Customs will then issue a Form C79 which is acceptable evidence for recovering the VAT as input tax subject to the normal rules.) (All business buyers from outside the UK should refer to 'VAT Refunds from HM Customs & Excise' for information on how to recover VAT incurred on the buyer's premium). Quantity: 1

Cognac Tesseron Lot No 53 X.O. Perfection NV Cognac Tesseron Lot No 53 X.O. Perfection NV Lots 153-155: Wax capsules, packed in individual presentation oc within oc Lot 153 ♦ 6 bts (oc) Lot 154 ♦ 6 bts (oc) Lot 155 ♦ 6 bts (oc) per lot: GBP 500-600 per lot: USD 650-780 per lot: EUR 580-700 LYING IN OCTAVIAN, WILTSHIRE Offered In Bond, available duty paid These items are in bond. The buyer has a choice of taking the item in bond (with the sale being made in bond) or taking the item duty paid. If taken in bond, VAT will not be charged on the hammer price. VAT will be charged at 20% on the buyer's premium which may not be cancelled or refunded by Sotheby's. If taken duty paid, when Sotheby's releases the property to buyers in the UK, the buyer will become the importer and must pay Sotheby's duty at the current rate and import VAT at 20% on the hammer price + duty which may not be cancelled or refunded by Sotheby's. VAT will be charged at 20% on the buyer's premium which may not be cancelled or refunded by Sotheby's. (VAT - registered buyers from the UK should note that the invoice issued by Sotheby's showing import VAT payable, is not suitable evidence for recovering that VAT. In order to recover this as input tax, a VAT registered buyer must purchase the wine in bond and clear it under his own name and VAT number. HM Customs will then issue a Form C79 which is acceptable evidence for recovering the VAT as input tax subject to the normal rules.) (All business buyers from outside the UK should refer to 'VAT Refunds from HM Customs & Excise' for information on how to recover VAT incurred on the buyer's premium). Quantity: 1

Testen Sie LotSearch und seine Premium-Features 7 Tage - ohne Kosten!

Lassen Sie sich automatisch über neue Objekte in kommenden Auktionen benachrichtigen.

Suchauftrag anlegen